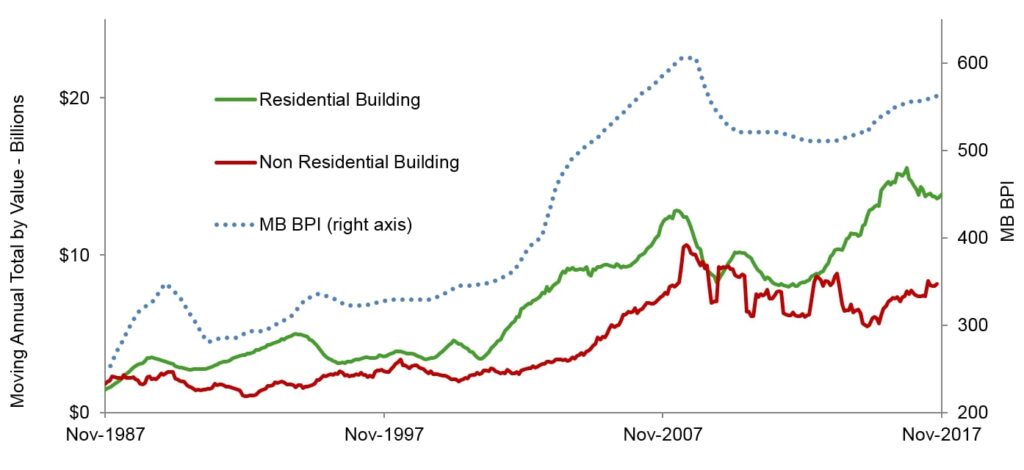

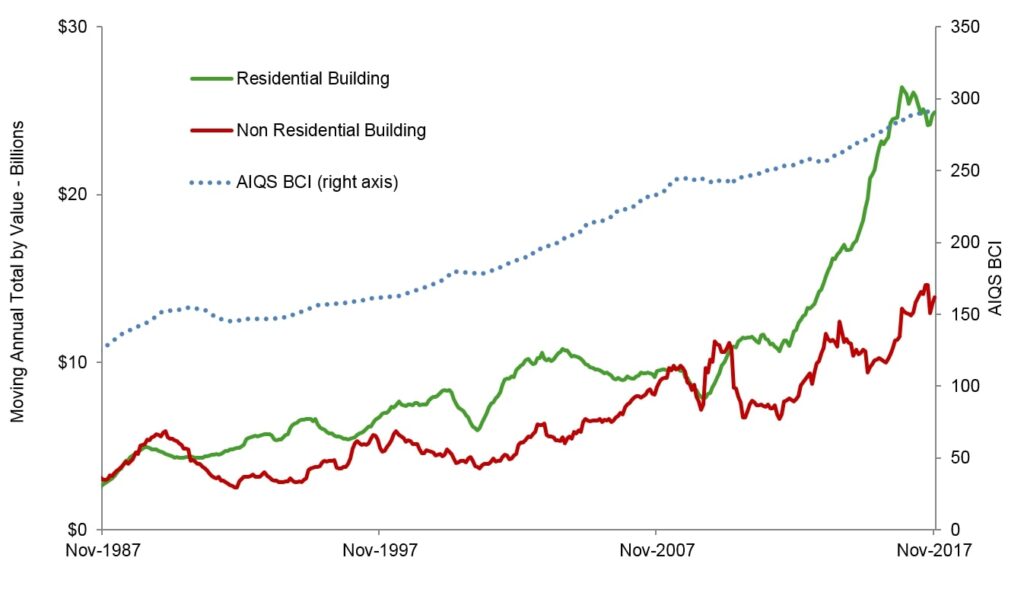

Will increased infrastructure spending offset the drop in residential approvals, and what will be the impact on residential construction costs over the next 12 months? Mitchell Brandtman explore the current residential construction cost market for 2018.

National Escalation Forecast

National Commentary

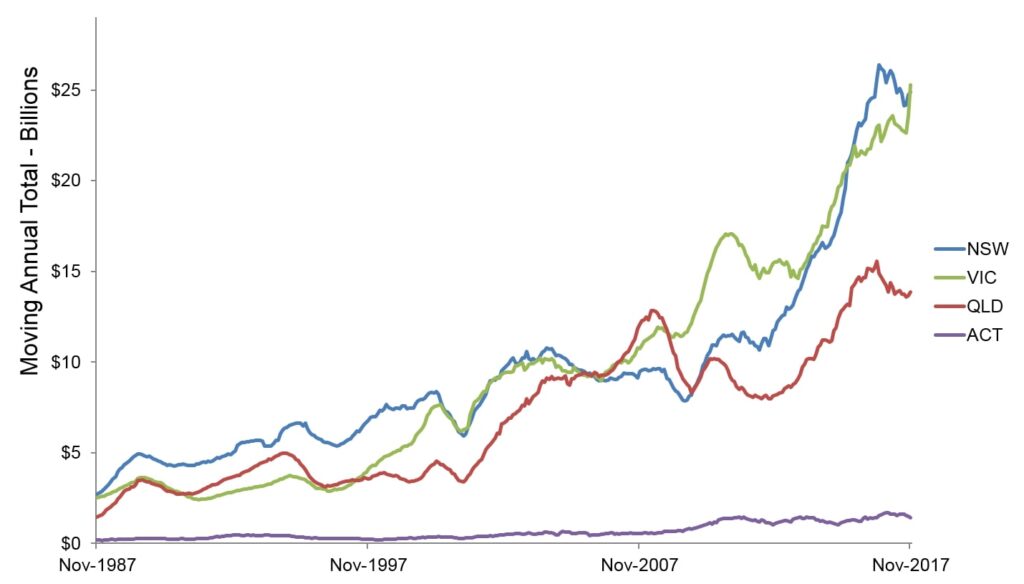

Residential Building Approvals

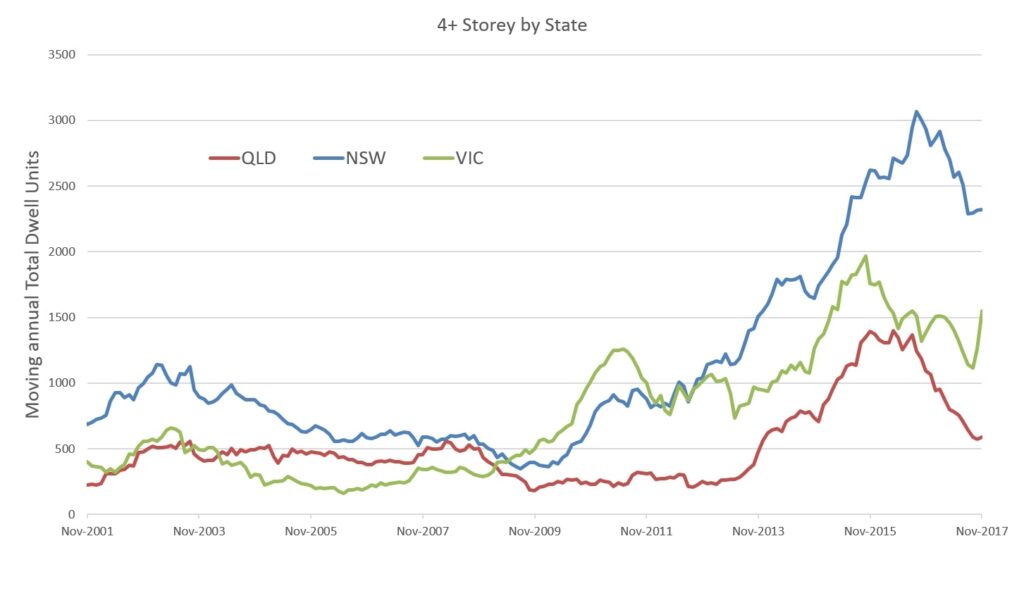

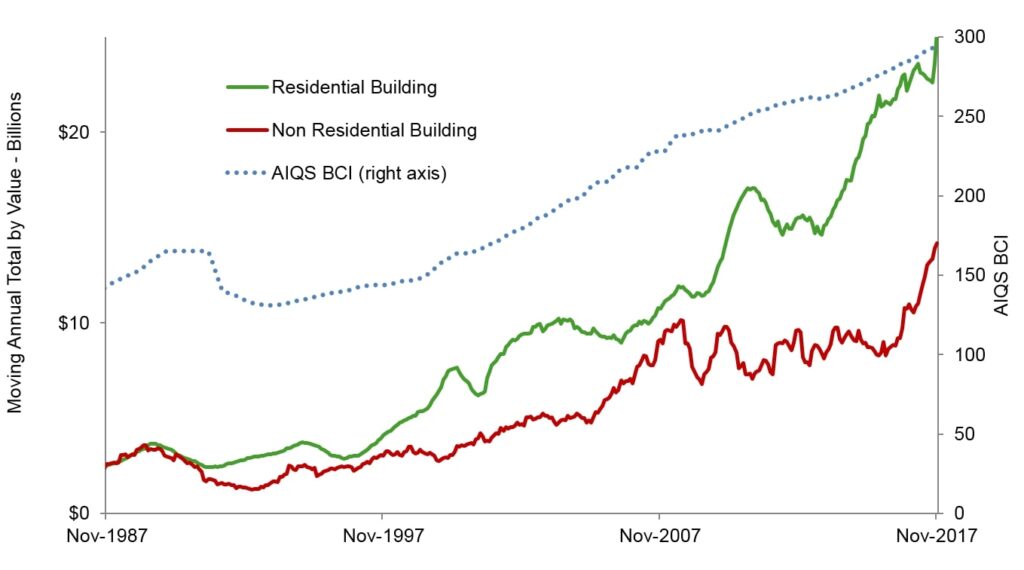

Regardless of where individual States sit, overall residential building approvals on the East Coast remain well above their long term averages. However the heat is starting to come out of the market and this is slowly starting to translate itself into reduced activity and confidence in some areas. When we look at approvals on a moving annual basis, we can identify that approvals for developments with more than 4+ Stories have been trending downwards for the last 12 months. While Victoria has bucked the trend with an upswing in residential approvals, the general feel is that national residential approvals will be off the previous high but still remain strong.

The following graphs highlight the turnaround in residential approvals across the East Coast. The market was being dominated by a proliferation of high density unit developments, however the focus on these developments took away the limelight from a strong growth in Townhouse developments. This sector, with the exception of QLD, still hasn’t found its peak and appetite remains strong.

It is worth noting we have seen a re-imagining of townhouse product to attract owner occupiers. There is increasing popularity of larger townhouses with 3-4 bedrooms and ample living and storage space. This change correlates to a changing product mix and target market for larger unit developments which had an impact on cost per unit over the last 2 years. Interestingly this change hasn’t yet followed through to smaller unit developments (3 storey walk-up product). It appears that this market is not at a stage where the increase in amenity would be reflected in increased sale prices. Developers that are seeing success at the moment are moving away from investors (particularly offshore) and embracing owner-occupiers, particularly in the more affordable middle to outer ring suburbs.

QLD Commentary

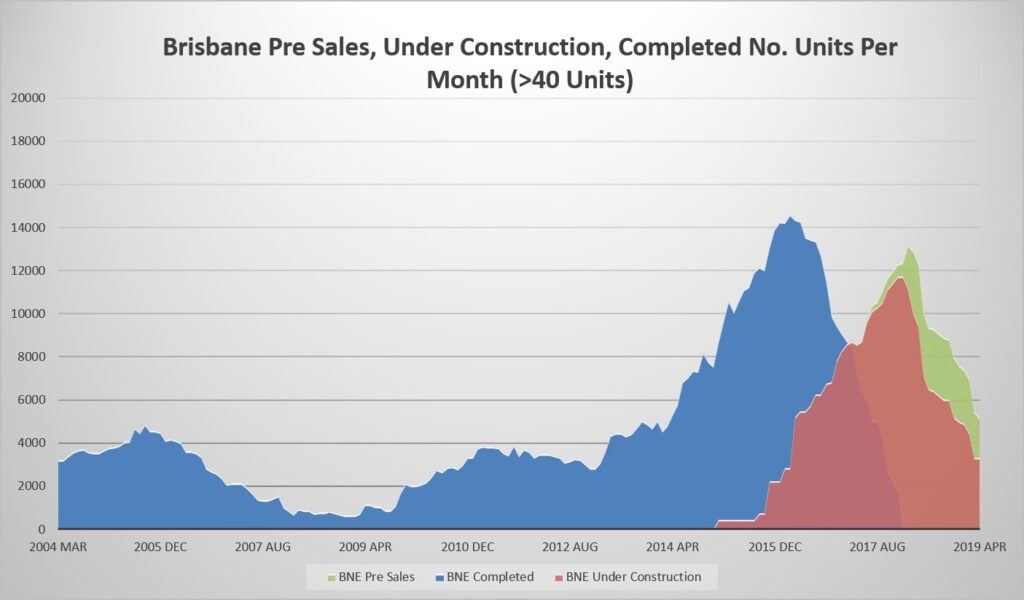

QLD Building Approvals

Drilling into South-East QLD and Brisbane in particular, we are seeing both residential approvals and residential construction down off peak numbers, however this needs to be taken in context. We are still currently constructing nearly twice the amount of our pre-GFC high. Major projects such as Queens Wharf, and the Howard Smith Wharves, alongside an increase in infrastructure projects continue to provide a buffer for contractors. However, despite the significant size of some of these projects, activity in these other sectors is not expected to counteract the slowing in activity overall and subsequent declining pressure on construction costs.

We do not expect residential construction costs to drop off dramatically at the head contract level, although there may be some opportunity to recoup margin at the sub-contract level.

Despite rumours to the contrary, Finance is obtainable for projects that stack up, however we are increasingly seeing experienced developers taping into alternate funders. The Big-4 banks are struggling with APRA and Basel Accords, and how this plays out on lending criteria and flows through to impact areas such as pre-sales and resistance to off-shore (and even interstate) buyers. Developers, while initially reluctant to pay a premium, are now becoming comfortable with the alternate lending offering and flexibility it offers.

NSW Commentary

NSW Building Approvals

NSW continues to go from strength to strength, across multiple sectors. Residential construction, infrastructure, commercial, and office all remain strong. While headline focus remains on roads and rail and the opening of new commercial hubs in the CBD, there is strength throughout the sectors.

Significant development opportunities still exist around both the new Western Sydney airport and Norwest rail link (due to open at the end of 2019). There will be significant amounts of stock coming online in these areas.

This is placing considerable pressure on both labour rates and trade availability. In particular finishing trades and formwork. There is no sign that this will ease in the near future and may be negatively impacted as infrastructure projects move into their build phases.

Regions such as the Illawarra and Hunter continue to thrive off the back of both the growth in the Sydney market and increases in local amenity. Supply of residential apartments and subdivisions in these areas is growing in line with demand. Some units in these areas are starting to find their price ceiling and the challenge going forward will be keeping product affordable.

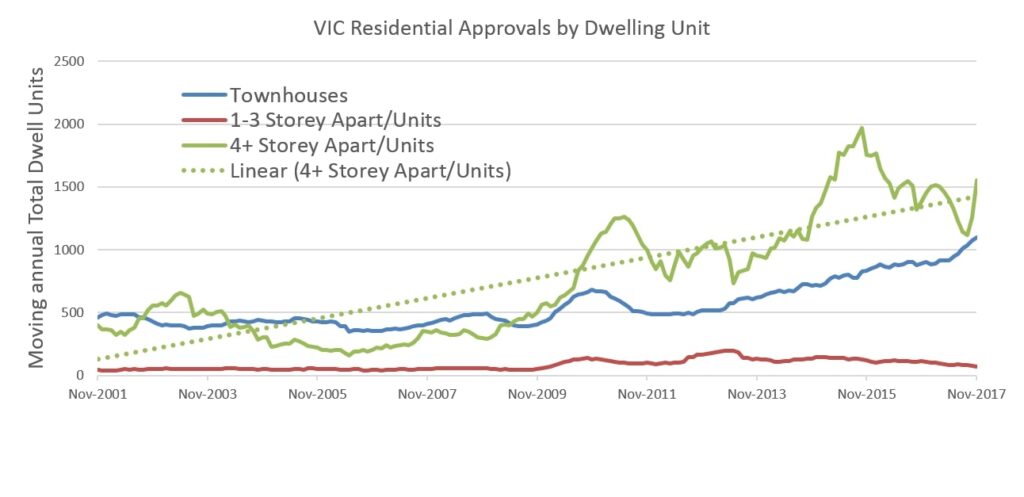

VIC Commentary

VIC Building Approvals

Infrastructure continues to compete for the limelight with the residential sector in an already buoyant Victorian construction market. Resi approvals kicked again, and it is interesting to look closer at the detail. Headline articles have painted larger apartment projects as in decline. While these have been lumpy, the medium term trend remains positive and any short term losses were partly being offset by strong gains in the townhouse sector. The recent kick in 4+ Storey Units may not be sustainable given that it is heavily influence by a small number of large projects being bought to market.

While there remains wage growth pressure, the slight shift from large scale unionised projects to mid-rise residential and civil projects is having a dampening effect, as is the slow release of non-residential projects.