Our tax depreciation and asset management specialists can help investors optimise their return on investment properties by reporting the maximised annual depreciation claimable to offset the owner’s assessable income.

A property that produces income will decrease in value over time as buildings and assets on that property wear out, a process called depreciation. As a property owner you are entitled by the ATO to claim the expense of depreciation over the years as a tax deduction. Tax depreciation enhances the value of your investment by putting more money in your pocket when you receive your tax return.

Tax Depreciation & Asset Management

Drawing on our extensive experience in the construction industry, our dedicated team will work with owners and managers of income-producing properties to maximise returns.

At Mitchell Brandtman, we are proactive in our approach, are comprehensive, and offer up-to-date advice and support to meet the needs of investors and owners of properties of all types and sizes.

Our expertise ranges from detached housing, townhouses, and high-rise units, to master-planned communities, retail, office, industrial, hotels and health developments.

We provide services that directly benefit:

We make for smarter investment

The ATO recommend that you only use a Quantity Surveyor to prepare a tax depreciation schedule, and enable you to claim the depreciation of your property against your taxable income. This is a highly detailed and particular area of advice, one that we are proud to specialise in.

Our Tax Depreciation Service goes beyond standard entitlements. We consider all factors which may lead to added value in the report including repairs, renovations and demolitions. If you are planning to renovate or redevelop, we can advise you on the best way to maximise your depreciation entitlements.

Tax Depreciation & Asset Management

- Commercial Tax Depreciation Schedule (Acquisition, Construction, Scrapping, Fitout Abandonment, Review existing)

- Residential Tax Depreciation Schedule

- Asset Registers Services

- Replacement Cost Estimate

- Depreciation Estimates for Sale / Marketing

- Sinking Fund Analysis MRF and CRF Reports

- Asset Management Plans for Commercial Properties

- End of lease make-good report

- Revisionary Depreciation Report

Optimise your tax benefits through our depreciation services, helping you unlock significant savings on your business operations or property investments. Our expertise spans across all industries, from office buildings to retail spaces, industrial complexes and beyond.

We can make your investment property work in your favour by increasing cash-flow through our 40-year depreciation schedule (or the remaining years of depreciation available thereof) for claiming non-cash deductions. Our qualified Quantity Surveyors and Registered Tax Agents will provide a detailed forensic analysis tailored to your specific properties.

Our location-based Asset Registers will analyse the Plants & Equipment for your business needs and form an essential document for operations management of your facility or assist with acquisition or disposal of property.

An up-to-date Insurance Replacement Cost Estimate ensures that building assets are accurately covered by your insurance provider in the event of significant damage. Given the volatility of the current market, when paired with the increasing inflation rate, it is imperative to have an accurate Insurance Replacement Cost Estimate on your building assets. Furthermore, our report will provide a comprehensive Replacement Cost Value of the property in the event of a natural disaster or accident.

To gain assurance of the appropriate quantum of insurance cover to protect your investments, this report will include;

- Demolition costs and removal of debris,

- Cost of escalation,

- Design and Supervision Fees for replacement,

- Estimate of cost to replace building.

We provide Indicative Depreciation Reports on typical residential or commercial units/properties to further assist your pre-sales and marketing needs. This provides potential buyers with an indicative depreciation estimate eligible for claiming a deduction when the project has reached construction completion.

We provide an analysis on the cost of maintaining the properties based on the life of assets within and make allowances for maintenance/repair works, as well as planned and unplanned capital works.

Our Asset Management Plan provides you with the cost of scheduled maintenance, unscheduled maintenance / reactive maintenance, and major periodic maintenance specifically for your buildings / complexes.

This analysis encompasses demolition works as well as looking at what needed done in way of repair replacement to make tenancy condition the same as it was at start of lease.

Maximise depreciation potential for landlords/owners by claiming the residual value on Division 43 at the end of tenant’s lease term.

For more than 50 years we have worked on over 42,000 projects within the building and construction industry in Australia, and globally.

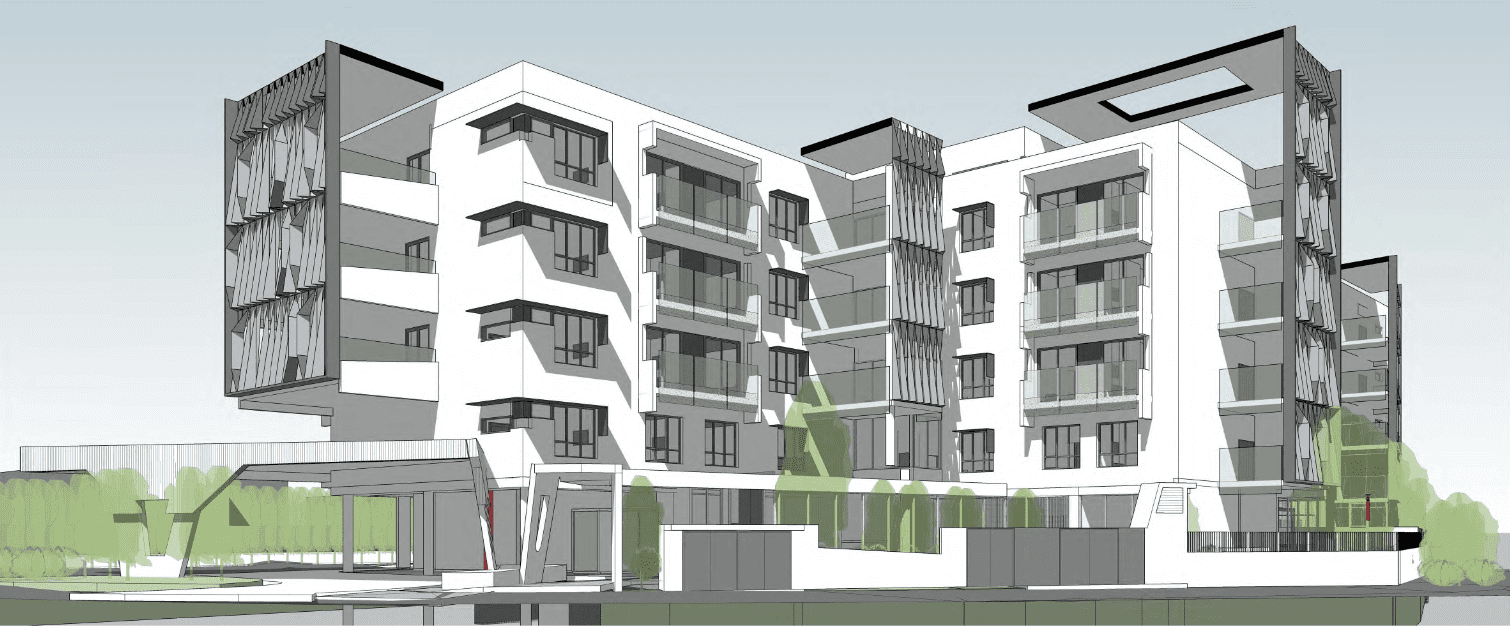

Here are just some of the projects we have completed and are currently working on.

Read More

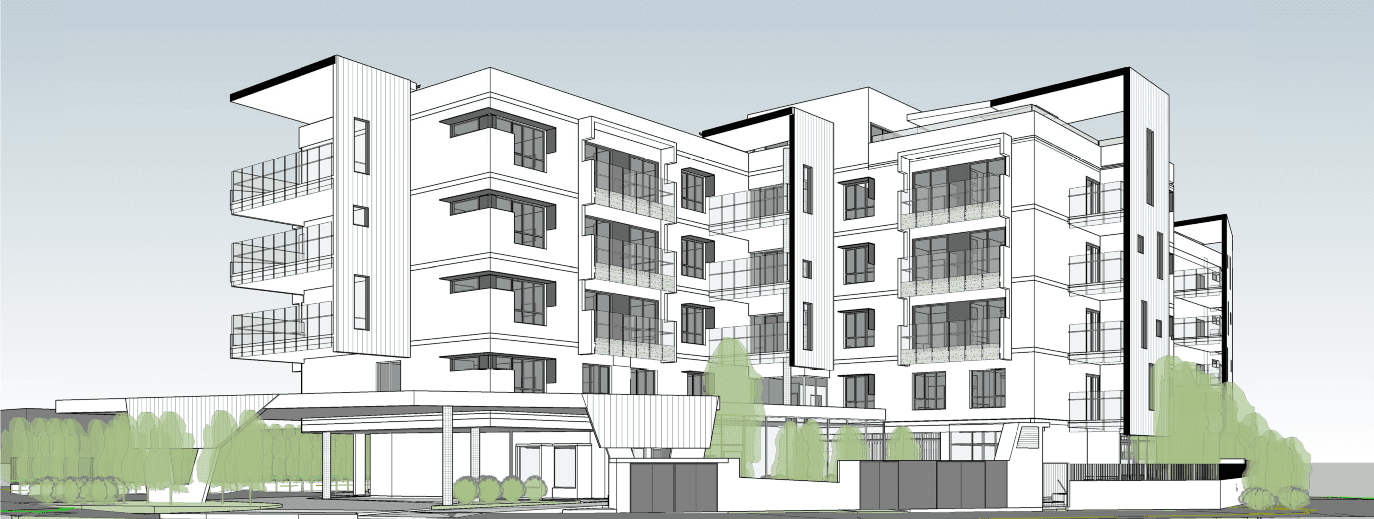

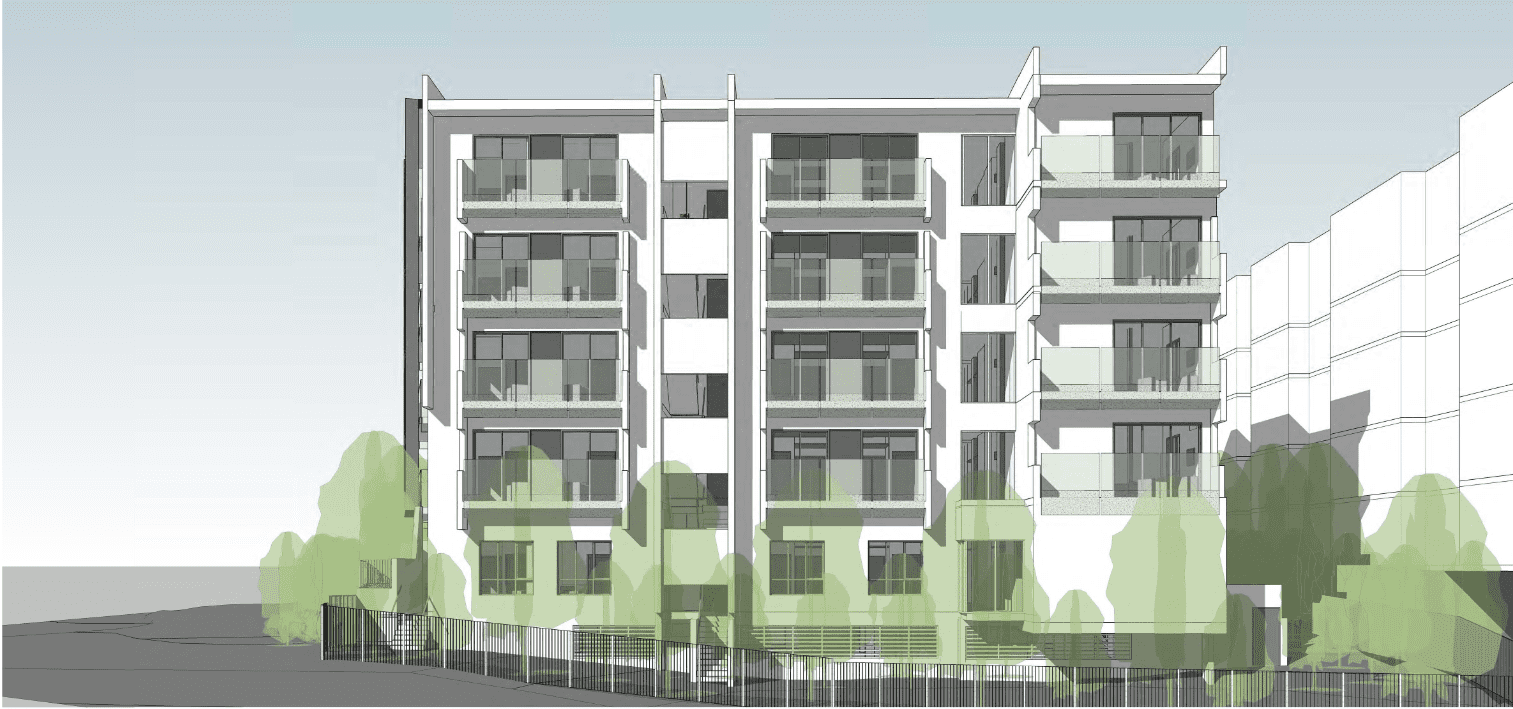

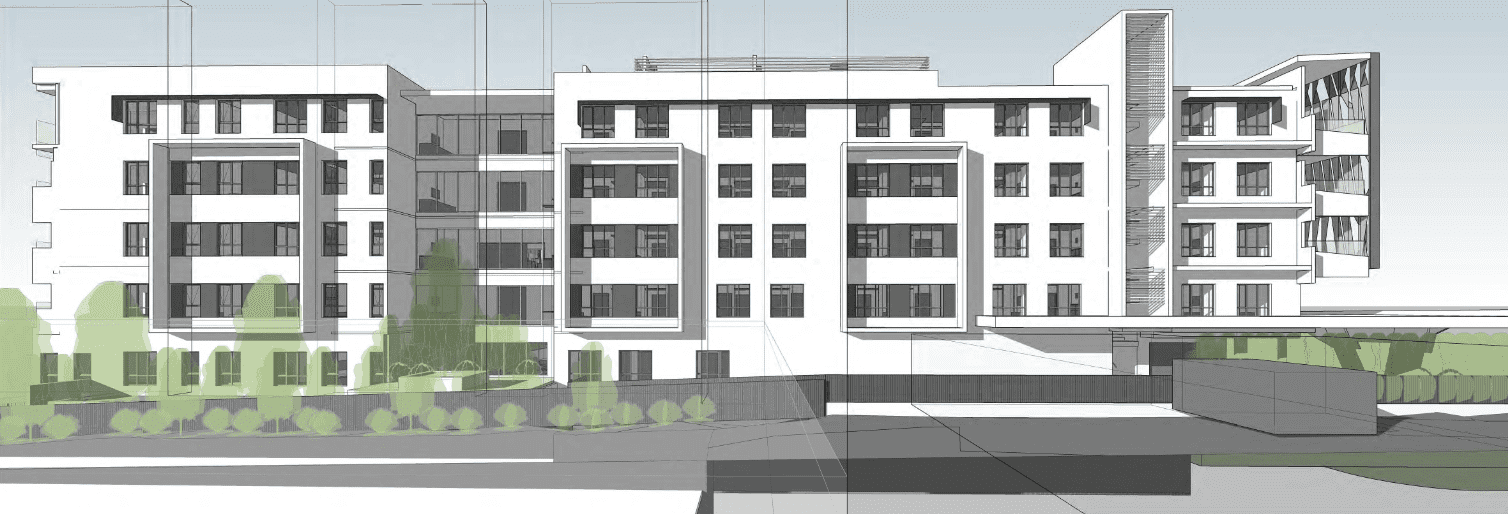

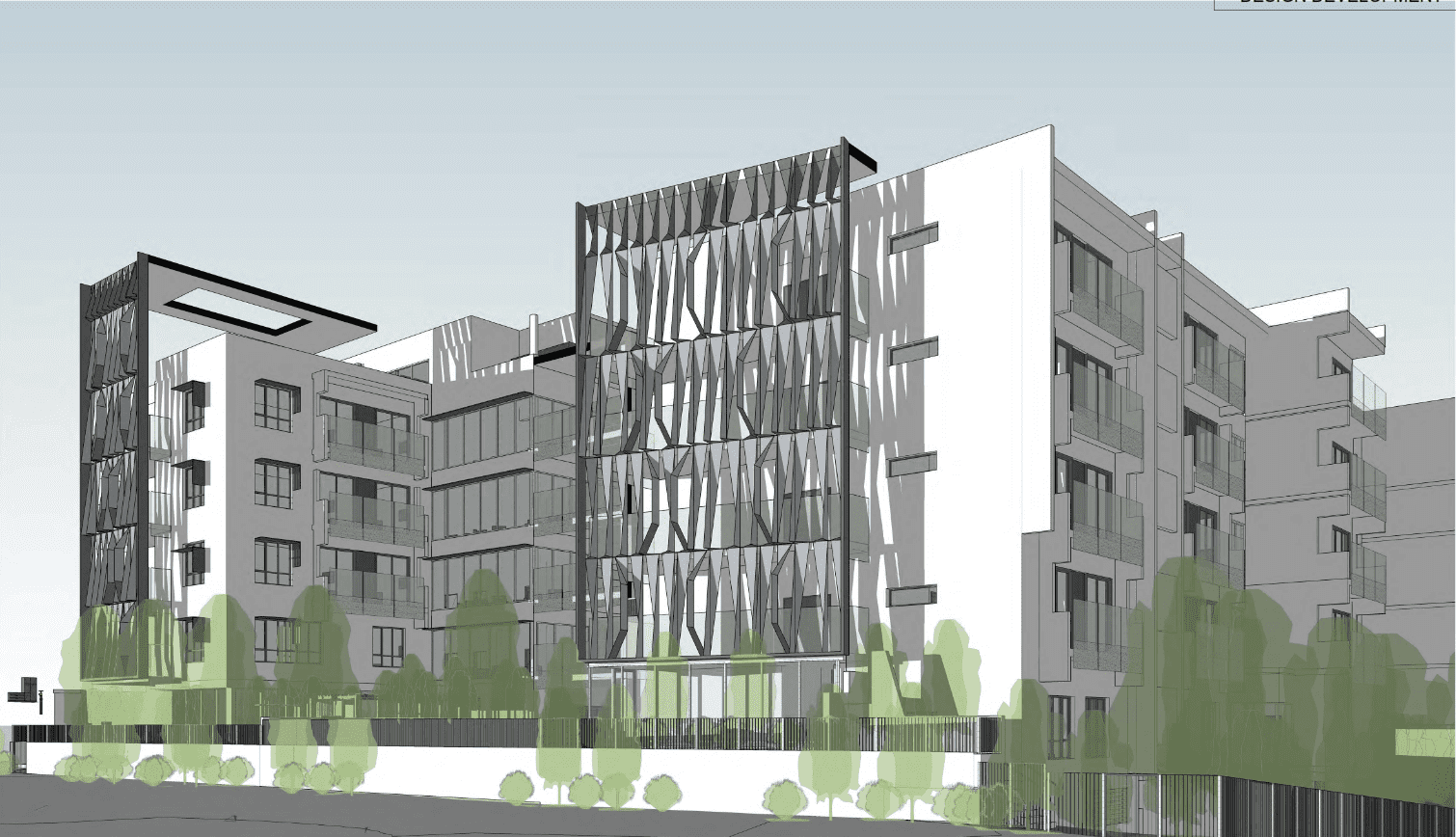

The Beach Apartments Broadbeach

Read More

100 Harris Street

Read More

Cronulla rsl

Read More

Regis Aged Care Lutwyche

Read More

Flour Mill Summer Hill

Read More

1888 Hotel Pyrmont

Read More

Croft and Cremorne by Stockwell

Read More

Eickhoff Braemar Industrial Project

Read More

The Flour Mill, Summer Hill

Read More

Bohemia Apartments Westend

Read More

Collegians Rugby League Football Club

Read More

Coles Fletcher

Read More

Casey Market Town

Read More