Over the past three to four years, the landscape of property development has been fundamentally reshaped. What used to be a relatively predictable process—site acquisition, design, funding, pre-sales, construction, delivery—now feels more like navigating a shifting puzzle where each piece moves against the other.

For developers, financiers, builders, architects, and consultants alike, the real question today isn’t, “How do we deliver this project?” but rather, “Does this project even stack up in the first place?”

Why is this so?

We have a few considerations here:

Increased Cost of Money: Development finance is no longer cheap. Higher interest rates and tighter lending conditions put pressures on feasibility models.

A Noticeable Reduction in Off-The-Plan Sales: Buyers are more cautious, driven by fears around reliability of delivery, construction defects, and an increasingly prominent “buyer beware” sentiment.

Market Trust: Well-publicised builder collapses and defect scandals have created an air of caution that directly affects pre-sales momentum.

The result is an environment where feasibility is under greater scrutiny than ever before. Deciding how best to use a site; whether it’s multi-unit residential, re-zoning from industrial to residential, renovating an existing home, or committing to an entirely new build, has become a far more complex process.

So, how have recent interest rate changes shaped the way clients approach projects and make decisions in property and construction today?

Looking back a few years helps us understand today’s climate:

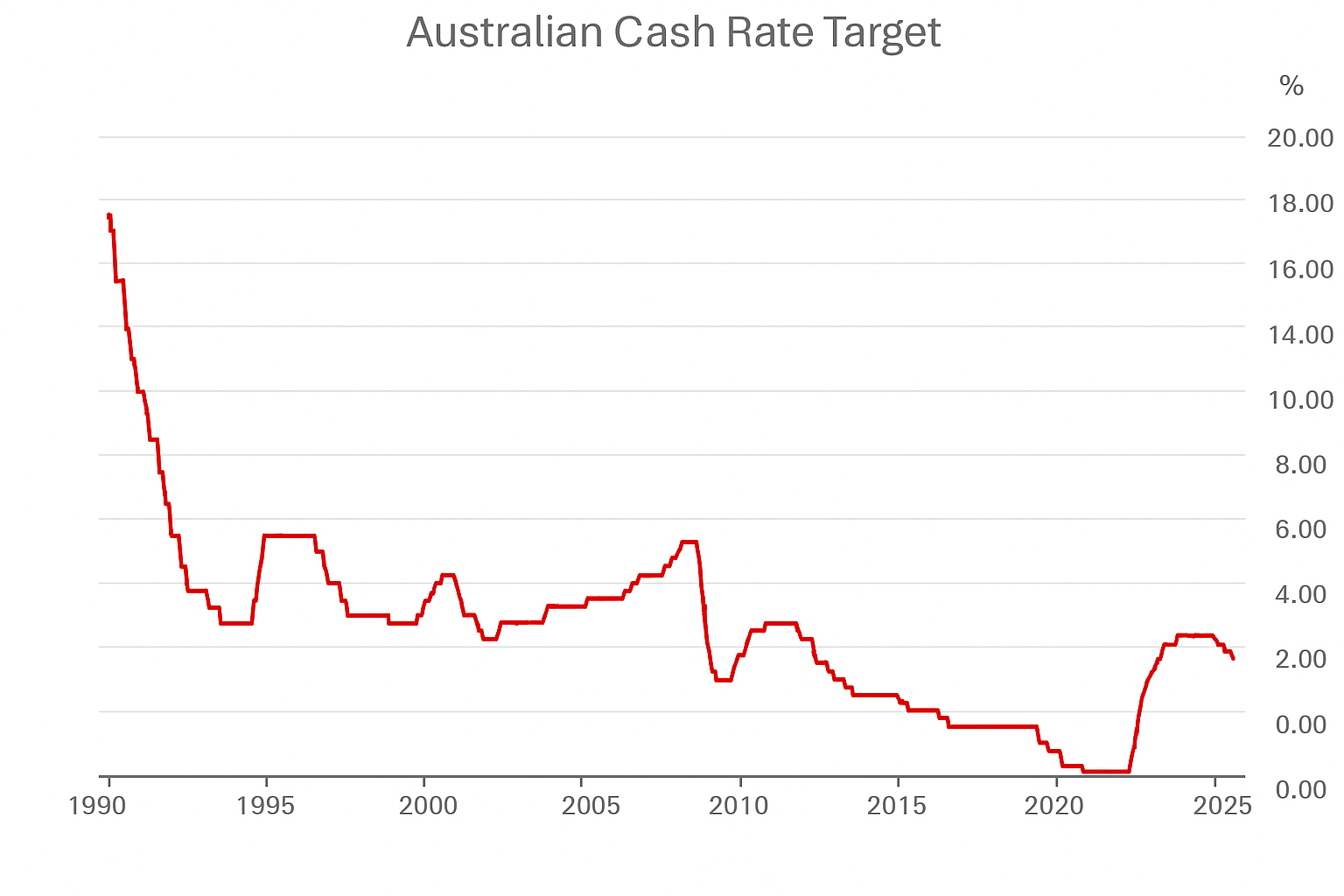

2021 to early 2022 – Record Lows: Interest rates sat at emergency levels, allowing developers to borrow at historic lows. This drove acquisitions, approvals, and strong off-the-plan sales.

Mid 2022 to 2023 – Rapid Rises: RBA lifted rates aggressively. In Australia, the cash rate rose from 0.10% in April 2022 to 4.35% by late 2023. Lending became harder, holding costs increased, and pre-sale requirements tightened.

2024 to today (Q3 2025) – Higher for Longer: Rates have stayed elevated, though recent small reductions have sparked activity and lifted confidence, both for development finance and end-user borrowing.

[Source: Reuters]

Even though rates have started to come down, borrowing is still far more expensive than what we have experienced previously. Lenders are cautious and expect developers to contribute more upfront, whether that’s funding site costs until early construction milestones are met, paying consultants and council fees in advance, or showing a stronger equity position overall, ensuring projects have a solid financial base before finance is released.

This shift in financing expectations has led to more project delays and, in some cases, cancellations.

Projects are now taking much longer at every stage. From planning and approvals to the detailed design phase and the lengthy tendering process. As a result, many projects have been put on hold while developers weigh up the best use of the site and the most workable funding structure. Where that isn’t possible, sites are being on-sold or abandoned.

ABS data shows that while dwelling approvals rose 11.9% to 17,076 in June 2025, which is the highest level since August 2022, dwelling commencements were down 11.8% since mid-2023, validating a growing approvals-to-starts gap [Source: ABS].

This shift has contributed to more project delays and cancellations. Projects have spent significantly longer in the planning and approvals phase (we’re seeing this well documented in the media) then, even longer in the Design/Construction Certificate stage, with rigorous design requirements to satisfy before a Construction Certificate is issued. At the same time, designs are refined to meet construction budgets, and the builder tendering process now stretches from initial tender through addendums, refinement and finally contract execution. This has created a significant number of projects ‘parked up’ or on hold while teams determine the best use of the site and the funding arrangement that allows a profitable start. If this cannot be achieved, sites are on‑sold or scrapped altogether. Over the past 2–3 years this scenario has risen markedly, well beyond anything I have seen in my 25 years in the industry.

In response to higher borrowing costs, both funding structures and development strategies have evolved.

We’re seeing several key shifts in how projects are funded and delivered:

Greater Equity Requirements: Banks want developers to commit more upfront equity to reduce their risk.

Pre-Sales and Buyer Confidence: With buyers cautious, larger developers are modelling ‘build to rent’ or ‘build to hold’ models to offset the need for pre-sales and tap into long-term financing. Smaller developers, who in a rising market, benefit from holding product back, continue to shop around for financiers who are prepared to take lower pre-sales.

Alternative Finance Options: Non-bank lenders and private capital are stepping in, often with higher interest but more flexible terms. Bridging finance and mezzanine debt are also becoming more common.

Joint Ventures / Capital Partnering: Developers are partnering with institutional or private investors to spread risk and attract senior debt.

Staged or Phased Delivery: Breaking projects into smaller stages reduces upfront costs and allows funding to match sales progress.

Value Engineering & Cost Certainty: Lenders now scrutinise Quantity Surveyors reports more closely than ever. Detailed cost planning and contingencies are essential for finance approval.

Focus on Product-Market Fit: Finance is only flowing to projects that clearly meet buyer demands in location, design and price.

Looking ahead, the indicators I’m watching closely over the next 12–18 months will shape how projects are planned and financed.

Several factors will influence the market in the coming year and a half:

- Borrowing Costs: Developers have had to shift from a low-interest rate paradigm to strategies that reflect funding in line with long-term averages.

- Timing of DA Approvals: Delays now hit harder, with each month adding finance costs, council fees and lost opportunities.

- Builder Tender Pricing: Builders are pricing risk into tenders with higher contingencies, pushing tender prices beyond CPI.

- Construction Price Indices & Trade Rates: Rising costs for raw materials, structural trades, services trades, and labour are driving up build costs across the board.

- Raw Materials: Concrete, steel, aluminium and glass have experienced global supply shocks, particularly in the recent past.

- Structural Trades: Formwork, reinforcement, façade systems and roofing remain at elevated rates due to capacity constraints.

- Market Dynamics and Supply Constraints: Land availability, planning delays, and labour shortages continue to limit the pace of new construction.

- Flow-On Effect: When you combine higher borrowing costs, approval delays, builder tender uplifts and rising trade prices, the impact on feasibility is magnified. What once appeared to be a viable site acquisition in 2020–21 may no longer stack up once today’s finance, approval and build cost realities are factored in.

The combined effect of higher borrowing costs, slower approvals, and rising build costs means that sites that looked viable a few years ago may no longer stack up under today’s conditions.

So, what does this mean for developers and homeowners planning projects in the current climate?

From a cost planning perspective, the challenge has shifted from simply “pricing a build” to “stress-testing” the project under real market conditions. Developers and financiers now rely on QS services not just to benchmark costs, but to provide insights on viability, funding confidence, and risk.

We, at Mitchell Brandtman, update cost plans through every stage, including council estimates, DA stage, approval, design documentation, tender reviews and cost-saving recommendations. Our database and knowledge of past experiences, past projects and real-world successes (and failures) all add to advice we can offer Developers and Financiers to ensure that projects are delivered on budget, on time and as specified.

The Key Questions Every Project Team Should Ask

- Am I relying on outdated assumptions about sales, funding or delivery?

- Do I have the level of cost certainty that lenders and investors need?

- Have I tested my project against multiple scenarios, including, interest rate changes, cost escalation and softer demand?

Looking Back and Looking Ahead

As I reflect on my 25 years in the industry, I want to thank our many clients – Developers, Builders, Architects, Engineers, Financiers and so many others – I’ve had the privilege of working with.

From our humble beginnings, we have grown into one of Australia’s leading Quantity Surveying practices, it has been an incredible journey.

At Mitchell Brandtman, we remain committed to providing expert cost management advice and sharing our knowledge with a service offering I am proud to say, is truly market leading in the Quantity Surveying field.