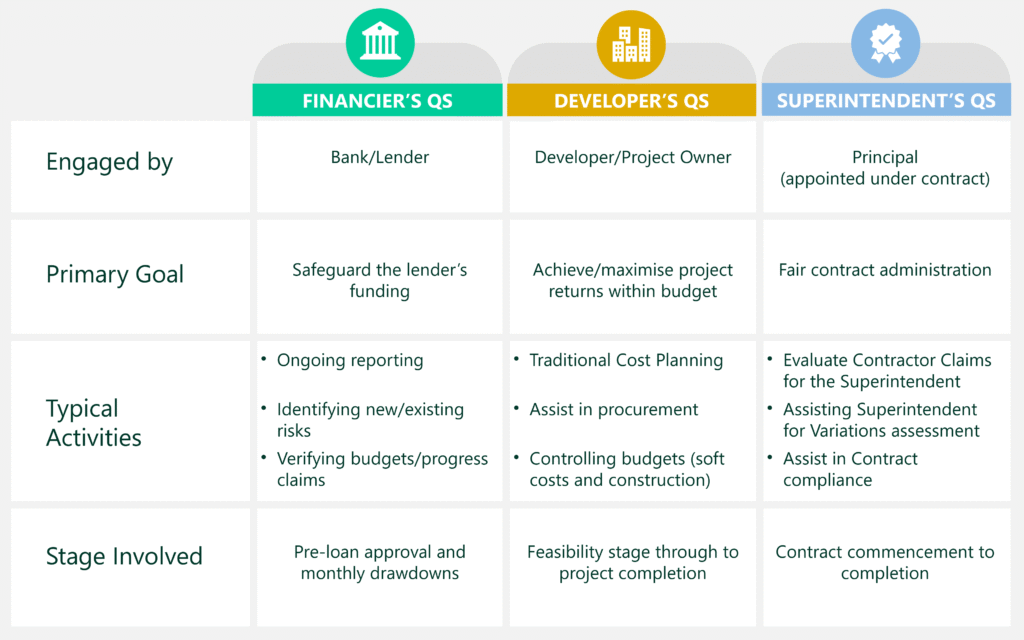

As construction projects become more complex and financial structures more layered, understanding the role and value of a Quantity Surveyor has become so important. While most in the industry know that a QS provides cost advice and oversight, it is in a project’s benefit for all to realise the very different responsibilities of a Financier’s QS, Developer’s QS, and Superintendent’s QS.

According to Tass Assarapin, Partner at Mitchell Brandtman and head of Mitchell Brandtman’s Sydney CBD office, these roles are often confused and sometimes blurred, but the distinction between them is critical.

“They’re technically three completely different roles. The Financier’s QS acts as a representative for the Financier, the Developer’s QS works on behalf of the Developer, and the Superintendent’s QS sits right in between, administering the contract independent of both sides.”

The Financier’s QS: The Eyes and Ears of the Lender

A Financier’s QS reports to the Financier, even though the Developer is usually the one paying their fee. Their brief is narrower, but no less important. A Financier will look to their QS to confirm the cost to complete, review the project funding table and assess if the program is achievable. They also review and comment on authority approvals and insurances, while providing independent reporting on progress and other potential risks.

“The Financier’s QS is accountable to the Financier,” Tass notes. “Their brief is specific, and they’re essentially the Financier’s eyes and ears on site.” It is a reporting-heavy role where independence is non-negotiable.

The Developer’s QS: Seeing it from the Developer’s Position

A Developer’s QS is engaged directly by the Developer, and their role is to work in the Developer’s best interests. This often begins with feasibility studies and cost planning and extends through to assessing progress claims and contract variations. The Developer’s QS is, in many ways, the Developer’s advocate, ensuring the project budgets are achievable and therefore keeping the budget viable.

“It’s basically a QS that’s there to assist the Developer in achieving the best outcome,” Tass explains.

The Superintendent’s QS: Independent Contract Administrator

Unlike the other two roles, the Superintendent’s QS is bound by the contract itself. They are not working for the Developer, the Financier, or the builder, but are instead there to oversee the contract independently in liaison with a project Superintendent.

A key responsibility is the assessment of variations, which, when handled correctly, can save a project significant cost and reduce disputes.

“With that independence, we see a great value in a QS assessing and determining the quantum of variations, as there could be millions of dollars saved just in the assessment of contract variations alone.”

Why Independence Matters

Tass cautions against attempts to combine roles, such as appointing the same QS as both the Financier’s QS and the Superintendent’s QS. In his view, this creates unnecessary conflict because the priorities of a Financier and the obligations of a Contract do not always match.

“We would strongly recommend keeping the Superintendent’s QS role completely independent from the role of the Financier’s QS,” he says. “The stipulations of a Contract can sometimes juxtapose with a Financier’s brief, particularly regarding things like cost to complete or unfixed materials.”

For example, Contracts may allow deposits and payments unfixed materials, but Financiers typically avoid this unless supported by unconditional Bank Guarantees. Contracts may permit milestone or cost-to-date payments, while Financiers usually require payments strictly aligned to cost-to-complete. These differences can quickly create friction, highlighting why independence between roles is essential to maintain trust and protect all parties.

Industry Observations and Insights

Across the industry, several observations are reshaping the QS landscape. “The briefs are getting bigger and bigger, and the Financiers are asking for additional reporting,” notes Tass, describing how lender requirements are pushing the Financier QS role toward quasi-project-management territory.

At the same time, he warns that “we’re seeing the Superintendent’s QS role decrease,” a trend that can be costly given the financial impact when independent oversight of contract variations is reduced.

Finally, Tass cautions Developers not to treat Financier’s QS reports as if they were their own: “Those reports are for the lender, the disclaimers make that very clear.” To protect their interests, Developers should always engage their own QS rather than relying on reports commissioned by Financiers.

The differences between a Developer’s QS, Financier’s QS, and Superintendent’s QS may seem subtle, but in practice, they can determine the success of a project. “The roles are kind of similar,” Tass reflects, “but it all comes down to who we’re working for.” For Developers, Financiers and builders, understanding these distinctions and ensuring independence where it matters helps create certainty and deliver better project outcomes, and Tass and his team at Mitchell Brandtman prove their expertise in these fields to get the job done.