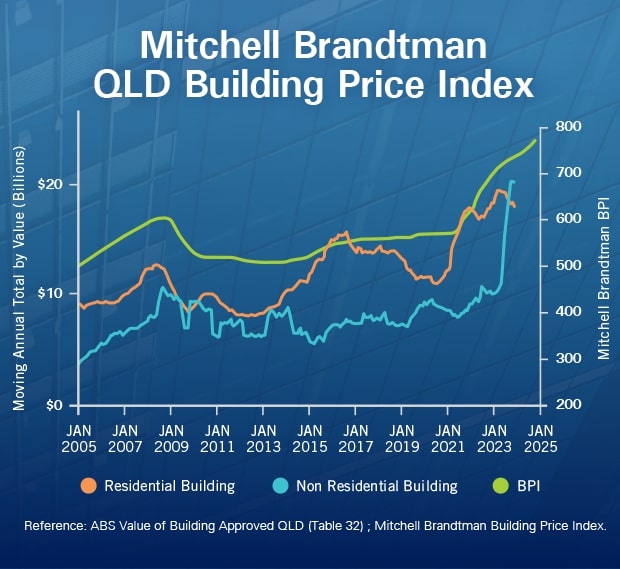

All eyes remain on public spending BA activity as it charters unprecedented territory.

The rolling data information indicators show it’s taken a slight dip in the last quarter but remains at incredibly high levels. This has been recognised by the State Government, driven by concerns of escalating costs which has prompted a much-needed independent review of Olympic Games infrastructure projects and their value-for-money propositions. Conversely, residential BAs continue a downward trend, albeit still at record high levels compared to pre-Covid times.

The 2023 / 2024 Summer season has wreaked havoc across the Qld coast with cyclones and flooding across the northern coast, and similar down the SE Qld pocket. Storm damage across the state is yet to feed into the insurance work that will absorb trades that crossover into the residential sector and potentially provide a short sharp spike in demand for particular trades such as roofing, cladding, flooring, linings, paint and plaster within the smaller scale developments.

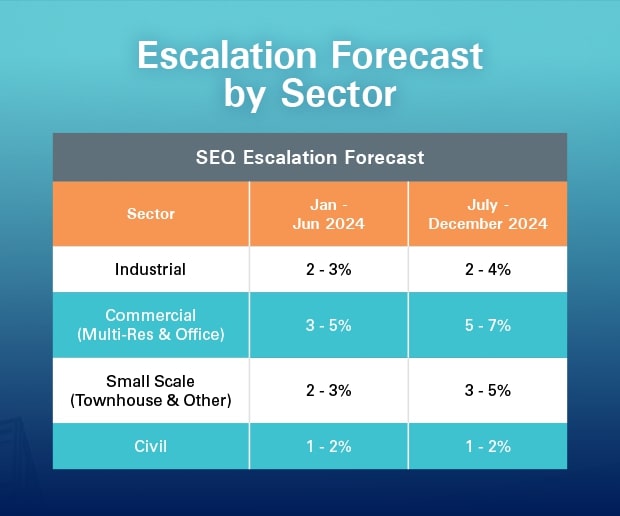

Feasibilities continue to be challenged across large scale multi-residential developments and institutional developments. There is an ease for smaller scale residential developments and industrial projects, however, the key to success is largely through leveraging developer/builder relationships.